HOSTED BY: 1 AIR TRAVEL

Credit cards with 0% annual percentage rates provide the advantage of avoiding interest payments on purchases, balance transfers or both for a limited duration.

But it’s important to note that the specific details of each card can vary significantly, with some offering longer introductory periods and additional perks compared to others. Additionally, charges associated with these cards, such as annual and balance transfer fees, can differ.

Before applying for a 0% introductory APR credit card, it’s essential to consider the following things to make an informed decision.

Check the offer type and length

FRESHSPLASH/GETTY IMAGES

While most 0% APR cards offer zero interest for at least 15 months, certain cards provide 0% introductory APRs that extend up to 21 months. The length of the offer is significant because it determines the period during which you will be exempt from paying interest. It signifies the duration before your credit card’s interest rate resets to the regular APR.

For instance, if you have a substantial purchase to make and require approximately a year to pay it off, any of the 0% introductory APR credit cards with 15-month introductory offers could be suitable. However, if you are dealing with a significant amount of high-interest credit card debt that needs to be paid off, it is advisable to seek out the longest 0% introductory offer available.

Additionally, 0% introductory APR credit cards offer their promotional rates for either purchases, balance transfers or sometimes both. In certain cases, these cards may even provide different timelines for zero interest on purchases and balance transfers.

For instance, you might receive 0% interest on purchases for 12 months while enjoying a 0% introductory APR on balance transfers for a longer period of 18 months.

Lastly, read the fine print to make sure you’re not missing anything and that you qualify for the offer you’re looking for.

re there any rewards or perks?Several credit cards that offer introductory APR periods also provide the benefit of earning rewards. However, it’s important to note that opting for rewards usually means sacrificing the length of the zero-interest offer.

Nevertheless, numerous cards offer both introductory APR periods and ongoing rewards, albeit with a shorter duration of 0% interest (typically up to 15 months). For example, the popular Chase Freedom Flex℠ usually has a valuable introductory APR offer and allows you to earn bonus cash back on travel, dining and drugstore purchases at the same time.

Also, ensure that your card offers perks that align with your preferences or offer benefits that you can make the most of. Common benefits include extended warranties, cellphone insurance, travel insurance and purchase protection against damage or theft.

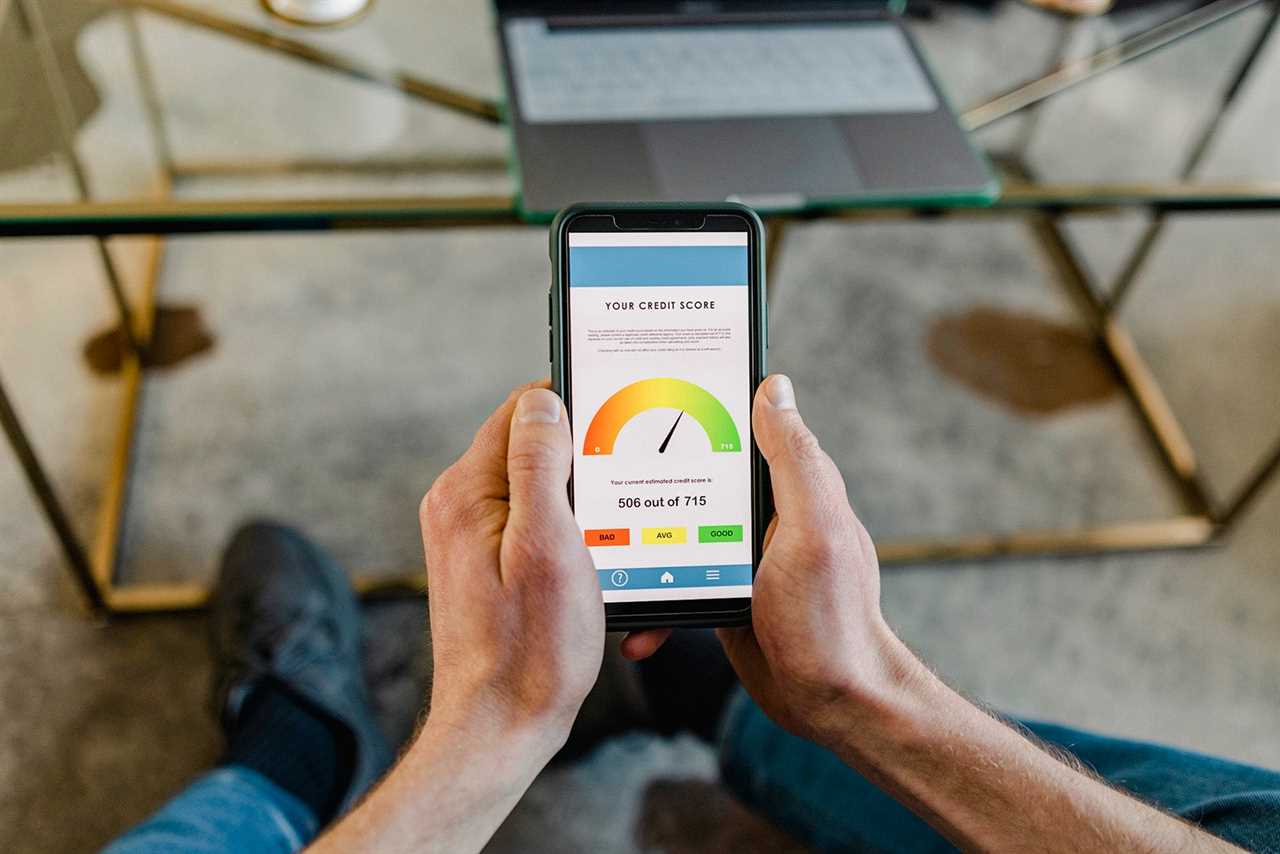

What credit score do you need to apply?

SOLSTOCK/GETTY IMAGES

While looking into the card details, it’s key to consider your eligibility for the desired 0% APR card. The top cards in this category generally require applicants to have a good to excellent credit score, so not everyone will qualify.

Before submitting your application, check your credit score to determine your realistic chance of approval. This step allows you to assess your creditworthiness and decide which cards to pursue.

What kind of fees are included?

Lastly, ensure that any card you’re considering has fees you’re comfortable paying. Here are some common fees associated with 0% APR cards:

Annual fees: While most credit cards offering a 0% introductory APR do not charge an annual fee, this may not always be the case. Verifying whether an annual fee applies to the card you are considering is essential.Balance transfer fees: If you plan to consolidate debt using your new 0% introductory APR credit card, the balance transfer fee becomes significant. While most cards in this category charge a balance transfer fee of 3%, a few cards charge up to 5% instead. Opting for a card with the lowest possible fee will help minimize the cost of transferring a balance.Foreign transaction fees: This fee is relevant if you intend to use the card for transactions overseas or with non-U.S. merchants online. If you frequently travel, avoiding cards that charge foreign transaction fees is advisable. Alternatively, you can consider using another card from your wallet when you are abroad to avoid these additional charges.By carefully considering and evaluating these fees, you can select a credit card that aligns with your financial preferences and minimizes any potential expenses.

Bottom line

Picking a 0% introductory APR credit card may feel overwhelming, but by looking into factors like required credit scores, associated fees, additional card perks and the offer duration that aligns with your repayment timeline, you can narrow down your options. For more assistance, check out our list of the best 0% introductory APR credit cards.

It’s important to note that in most cases, there are multiple 0% introductory APR credit cards that can suit your needs. Once you have researched and confirmed that your credit is likely sufficient for approval, applying before the offer expires is key.

Title: How to choose a credit card with 0% APR

Sourced From: thepointsguy.com/guide/how-to-choose-zero-apr-credit-card/

Published Date: Mon, 23 Oct 2023 14:00:12 +0000