HOSTED BY: 1 AIR TRAVEL

The extreme couponing fad may be over, but cash-back deals via credit card offers are thriving.

While we once only had Amex Offers, we’re now seeing similar programs from other major issuers, giving their customers even more ways to save.

Every program works similarly: Log into your card account online or through your banking app, review the offers available to you, add the ones you want and make a qualifying purchase using the card the offer is registered to. There are no promo codes to enter at online checkout and no coupons to print to take to the register. It’s the simple type of couponing everyone loves.

Offers are typically targeted, but someone with multiple cards will have access to dozens of offers from various retailers at any given time. Though every little bit helps, some programs are more valuable than others. Here’s how the programs stack up.

New to The Points Guy? Sign up for our daily newsletter and check out our beginner’s guide

In This Post

mex offers(Photo by Isabelle Raphael for The Points Guy)

Nearly everyone with an Amex card is familiar with Amex Offers, where you’ll often find 100 or more potential discounts for each card you have. Not all of them will be relevant to your purchasing needs, but the law of large numbers says a few will probably make sense.

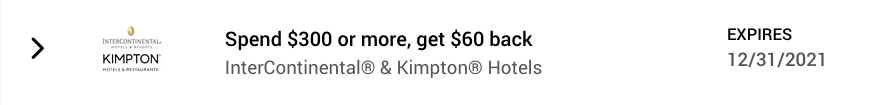

From a traveler’s perspective, Amex Offers are frequently a good fit. Hotel offers are relatively common and often span multiple brands. For instance, here’s one where, when you spend $300 or more with Intercontinental or Kimpton Hotels, you get $60 back.

(Screenshot courtesy of americanexpress.com)

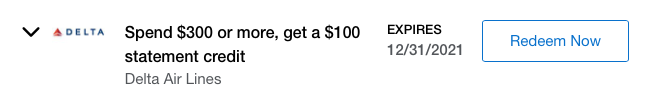

Sometimes, you’ll find a good airline offer, too, like this one for a $100 statement credit on a Delta purchase of $300 or more

(Screenshot from americanexpress.com)

In addition to sheer quantity of offers available, Amex also tends to field some of the highest cash-back deals. Rebates of $100 or more are relatively common, and you can sometimes stack Amex Offers with other discounts and promotions as long as your final purchase price is high enough to trigger the deal.

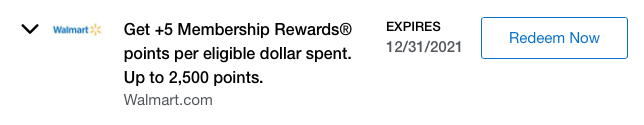

Another great advantage to these offers is that Membership Rewards-earning cards sometimes proffer bonus points on eligible purchases rather than cash back. For example, you may find an offer for 10,000 bonus points instead of $100 or 5 extra bonus points per dollar instead of 5% cash back on certain types of purchases or from specific retailers.

Since TPG values Membership Rewards at 2 cents each, earning your rebate in points can make it an even sweeter deal.

(Screenshot from americanexpress.com)

One major downside is that Amex usually structures deals to require a minimum spending amount (as you might imagine, the higher rebates require higher spending to qualify), and taxes and fees are generally not included in that amount. So if you spend even just one penny short of the amount stated in your Amex Offer, you could miss out on the deal entirely.

Further, note that some Amex Offers have restrictions around what purchases are eligible, so read through the terms and conditions before you make a purchase. Also note that you can only add a particular Amex Offer to one Amex card, so try adding it to the card that earns the most points on your purchase.

Interested in using Amex Offers? Consider applying for one of these Amex cards:

American Express® Green Card Earn 30,000 Membership Rewards points after you spend $2,000 on purchases within the first three months of card membership. Earn 3x points on dining at restaurants, travel and transit (including flights, hotels, cruises, taxis, tours and more) and 1x points on other purchases ($150 annual fee; see rates and fees).American Express® Gold Card Earn 60,000 Membership Rewards points after you spend $4,000 on eligible purchases with your new card within the first six months of card membership. Earn 4x points on dining at restaurants, 4x points at U.S. supermarkets (on up to $25,000 per calendar year, then 1x), 3x points on airfare purchased directly from airlines or American Express Travel and 1x points on other eligible purchases ($250 annual fee; see rates and fees).The Platinum Card® from American Express Earn 100,000 Membership Rewards points after you spend $6,000 on purchases in your first six months of card membership. Earn 5x points on airfare purchased directly from airlines or with American Express Travel (on up to $500,000 on these purchases per calendar year), 5x points on prepaid hotels booked with American Express Travel and Amex Fine Hotels + Resorts and 1x points on other purchases ($695 annual fee; see rates and fees).The information for the Amex Green Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: These Amex Offers will help you save money and make life easier right now

Chase offers

(Photo by John Gribben for The Points Guy)

Since so many of our favorite travel cards are issued by Chase, there’s a good chance you have access to Chase Offers in your wallet.

Chase Offers are targeted and may vary by card. You’ll need to check each card in your account to see which ones you have access to. In my experience, the best deals are usually on the cards I rarely use, which might give you an incentive to pull them out of the sock drawer again.

Currently, I have 13 offers on my Chase Sapphire Preferred Card, but there are 75 with the Southwest cobranded card I rarely use. If you see the same offer on multiple cards, be careful which one you add it to because you can’t add identical offers to multiple cards.

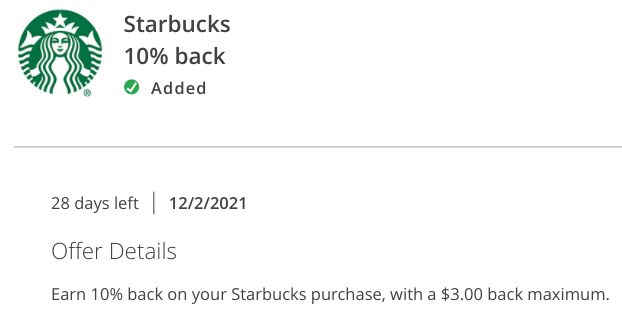

Chase Offers are nearly always a percentage back instead of a flat rate dollar amount, with a few exceptions for subscription-based products. That makes these offers easier to use since you can spend normally without worrying about hitting a minimum threshold in your shopping cart. Everyday brands (rather than stores you’ve never heard of) are often featured, with recent offers from places like Starbucks, McDonald’s and Best Buy.

On the flip side, Chase Offers are generally not as valuable as Amex Offers. Instead of getting triple-digit rebates, you’ll find quite a few that are barely worth getting excited about. For example, this Starbucks offer has a $3 maximum savings.

This Chase Offer for Starbucks tops out at $3. (Screenshot from chase.com)

Here are a handful of our favorite Chase cards:

Chase Sapphire Preferred Card Earn 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. Its earning rates include 3 Ultimate Rewards points per dollar on dining and 2 Ultimate Rewards points per dollar on travel purchases.Chase Sapphire Reserve Earn 50,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. Its earning rates include 3 Ultimate Rewards points per dollar on travel and dining purchases.Related: Your ultimate guide to Chase Offers

BankAmeriDeals

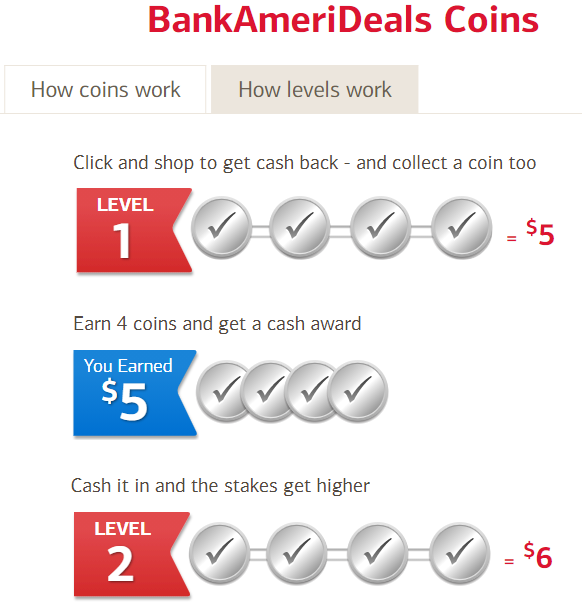

Bank of America also has a cash-back program with a great extra twist: Bank of America debit cards can also activate offers on their account (though we at TPG think credit cards are usually the smarter choice for most). Either way, it can take up to 30 days to see offers on your account after enrolling your account, so you’ll need to be patient before you can start saving.

The offers you see on your Bank of America cards may overlap with your Chase Offers, since the same backend system seemingly powers both programs. Bank of America does have an extra way to save through their BankAmeriDeals. In addition to the cash credits you get for completing offers, you’ll also earn a “coin” each time you utilize a deal. After earning four coins within a set amount of time, you’ll receive an extra cash bonus.

(Screenshot from bankofamerica.com)

Note that these bonuses post to your account later than the initial earnings – but they can be a nice bonus if you regularly use your Bank of America credit card.

Related: How to maximize your earning with the Bank of America Premium Rewards card

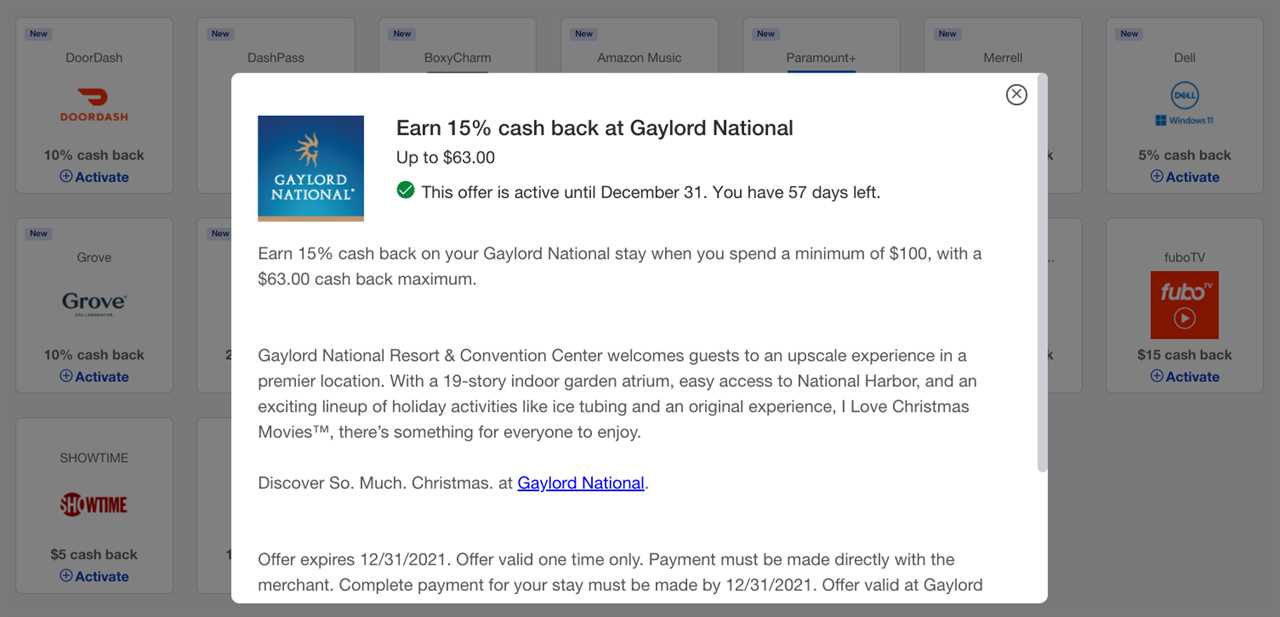

Citi merchant offers

(Photo by John Gribben for The Points Guy)

Citibank launched its Citi Merchant Offers program less than a year ago to compete with other issuers, but not all Citi cards are eligible. You can check your specific cards by logging in to your Citi account and navigating to this link.

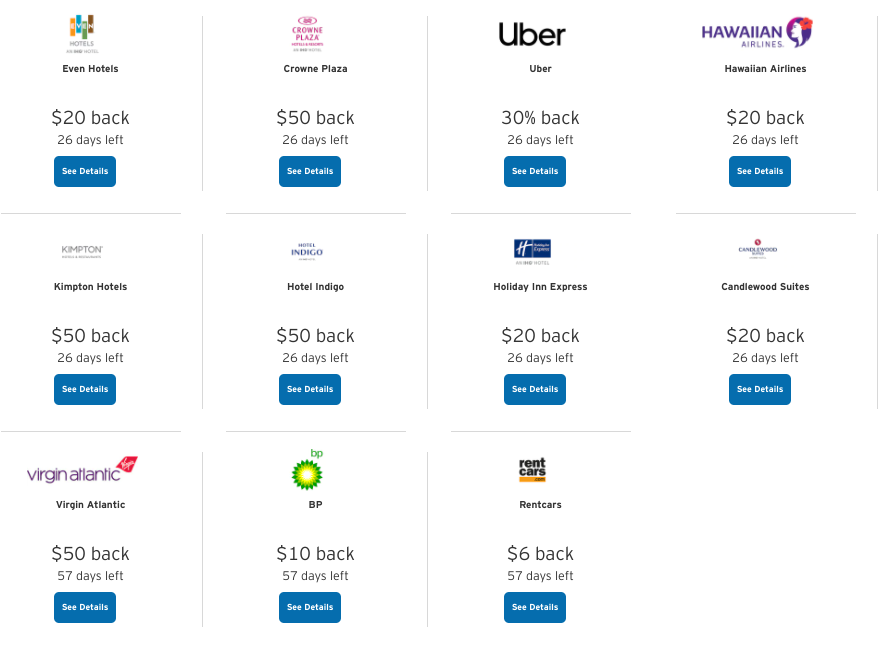

Like Amex, Citi fields offers from a huge volume of merchants. At the time of writing, I have more than 156 offers available on my Citi® Double Cash Card alone. Offers are conveniently sorted by category, and I’m always thrilled to see the travel offers sitting right on top.

(Screenshot from citi.com)

More often than not, the promos on my account line up well with brands I use anyway. Enrolling is tedious since you have to click the “See Details” button and then enroll, but it’s worth it to me since the deals are often relevant and lucrative enough to be interesting.

(Screenshot from citi.com)

With Citi, the devil is in the details. The fine print of each offer is often very specific, so make sure your purchase is in line with the terms and conditions. For example, chain restaurants may only be valid at specific locations rather than nationwide and sometimes travel discounts only apply to prepaid bookings. Still, if you see deals like $250 off $1,000, which I currently have for a Carnival Cruise purchase, it’s significant enough to be worth your time.

If you’re looking for a new Citi card, consider applying for the Citi Premier® Card. It currently offers 80,000 ThankYou points after you spend $4,000 on purchases in the first three months of account opening, which you can use for many great redemptions.

Related: 4 reasons the Citi Premier Card should be on your short list

U.S. Bank cash-back deals

U.S. Bank’s version of a rewards program was introduced without fanfare in 2021 and uses the same backend system as you see on Chase and BankAmeriDeals.

(Screenshot from usbank.com)

Though that means you might not see something new or noteworthy, it does mean you have another opportunity to load an offer to your account, especially since so many discounts are capped at low dollar amounts.

Unlike Chase, U.S. Bank doesn’t require you to load an offer to a specific U.S. Bank-issued card. Once you activate an offer, it’s valid for any of the cards on your account, but you can only use it once.

Related: How to choose the right credit card for you

Stack with a shopping portal

(Photo by JGI/Tom Grill/Getty Images)

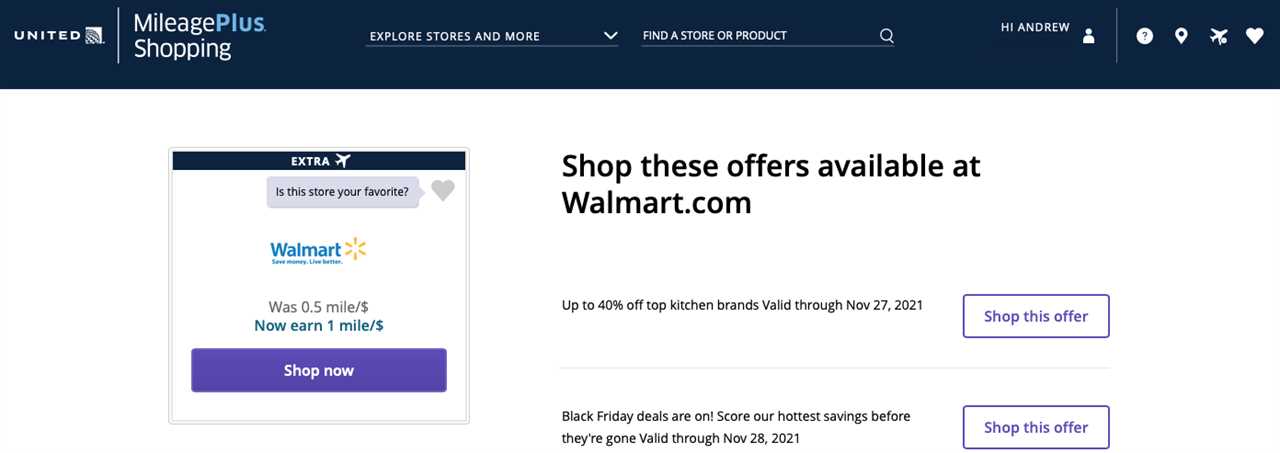

Barring some specific Amex Offers, the bulk of these merchant-specific offers trigger when you make an eligible purchase with your credit card. You do not always need to click through a special link to use your offers, meaning you can stack with a popular airline, hotel or cash-back shopping portal to earn even more points.

Shopping portals reward you with bonus points when you click through the portal before making a purchase with a specific merchant. For example, the United shopping portal currently offers 1 mile per dollar at Walmart. So if you have a Walmart Amex Offer, you can click through the United portal first, pay with your Amex and earn bonus United miles and Membership Rewards points on your purchase.

(Screenshot from shopping.mileageplus.com)

Most of the major airlines, many major hotels and even some transferable points currencies have shopping portals of their own. One of my favorites is Rakuten — it’s technically a cash-back portal, but you can opt to earn Amex Membership Rewards points instead. The portal is currently offering new members a $40 (or 4,000 Membership Rewards point) bonus after you spend $40 within 90 days of opening your account.

Consider using a shopping portal aggregator to earn the most rewards on your purchases. These will show you earning rates for all the major portals side-by-side, so you always get the highest possible return on your purchases.

Related: Don’t want to miss out on earning bonus points? There’s an extension for that

Bottom line

Since more issuers have jumped on the merchant offers bandwagon, you might have access to a plethora of different discounts or bonuses to enjoy across your credit card portfolio. Amex tends to have the most headline-worthy rebates, but realistically, the best offers will be those at retailers you shop with anyway.

Try and make it a habit to look through all of your available offers and add the ones you might use. There’s no harm in not using a linked offer and you might as well save money where you can. Just make sure to use the card with the linked offer when you pay for your purchase.

For rates and fees of the Amex Green, click here. For rates and fees of the Amex Gold card, click here. For rates and fees of the Amex Platinum card, click here.

Feature photo by Maskot/Getty Images.

Title: Extreme couponing: How credit card merchant offers can save you hundreds of dollars every year

Sourced From: thepointsguy.com/news/credit-card-merchant-offers/

Published Date: Wed, 24 Nov 2021 17:30:21 +0000