HOSTED BY: 1 AIR TRAVEL

When the Capital One Venture Rewards Credit Card first launched in 2010, it looked very different than the Venture we know and love today.

The now-familiar $95-annual-fee card earned 2 miles per dollar on all purchases, which could be redeemed for travel at 1 cent apiece. That formula has won it TPG’s award for simplicity and value.

The Venture has only gotten better over time — and particularly within the last few years. First, it added a Global Entry/TSA PreCheck credit. In 2018, the issuer also introduced travel transfer partners to the Capital One Miles program. And even in the past couple of months, Capital One has improved its transfer rates and opened its first airport lounge in Dallas-Fort Worth International Airport (DFW).

More than a decade since the Venture launched, Capital One continues to grow its presence in the travel credit card space. To rival long-standing premium competitors from issuers like American Express and Chase, Capital One recently launched the Capital One Venture X Rewards Credit Card.

As Capital One’s first truly premium travel credit card, the Venture X takes travel rewards and benefits to the next level. With a $395 annual fee, it’s more affordable than The Platinum Card® from American Express and the Chase Sapphire Reserve, yet offers a similar cadre of benefits, which makes the Venture X one of the best credit cards on the market today.

If you don’t carry either card — the Venture or the Venture X — you may wonder: Should you apply for the well-established, crowd-pleasing Venture or shake things up with the all-new but higher-priced Venture X? We’ll dive into a deep analysis of both cards to help travelers decide which Capital One card is the better fit for your needs.

Want more credit card news and advice delivered to your inbox? Sign up for TPG’s daily newsletter.

In This Post

Comparing the Venture X and Venture

CardCapital One Venture XCapital One VentureAnnual fee$395$95Sign-up bonusEarn 100,000 bonus miles after spending $10,000 in the first six months of account opening. For a limited time only, get up to $200 back in statement credits for vacation rental purchases (such as Airbnb or Vrbo) charged to your account within the first year of account opening.Earn 60,000 bonus miles after spending $3,000 in the first three months of account opening.Earning rates10 miles per dollar on hotels and rental cars booked through Capital One Travel.5 miles per dollar on flights booked through Capital One Travel.2 miles per dollar on all other eligible purchases.5 miles per dollar on hotels and rental cars booked through Capital One Travel.2 miles per dollar on all other eligible purchases.Other benefitsGet up to a $300 annual travel credit for bookings made through Capital One Travel.Complimentary access to Capital One lounges. Bring two free guests per visit, and pay $45 per additional guest.Get up to 10,000 bonus miles every year, starting on your first anniversary.Priority Pass membership for access to over 1,300 airport lounges worldwide for you and up to two guests per visit.Receive up to $100 in credit for Global Entry or TSA PreCheck every four years.Complimentary Hertz President’s Circle elite status.Up to four free authorized users, and they also get Capital One Lounge access with up to two guests.Cellphone protection with reimbursement up to $800 per claim with a $50 deductible.Receive up to $100 in credit for Global Entry or TSA PreCheck every four years.Two annual one-time visit passes to Capital One lounges.Complimentary Hertz Five Star elite status.Free additional cardholders.Foreign transaction feesNoneNoneFor an annual fee difference of $300, you’ll get a substantially larger welcome bonus, unlimited lounge access and more. But are all of these perks worth it? We’ll put these cards to the test in the following sections.

Welcome offer

How would you like to fly Lufthansa first class for less than 90,000 Capital One miles? (Photo by Zach Griff/The Points Guy)

TPG recently raised its valuation of Capital One miles from 1.7 to 1.85 cents per mile, thanks to many positive changes to the issuer’s rewards program, including adding four new transfer partners and improving the transfer ratio with most to a 1:1 basis. Not only will you get more value from all of the Capital One miles you accrue from the earning rate, but this widens the gap between the sign-up bonuses on the Venture X and Venture.

With the Venture X, you’ll earn 100,000 bonus miles after you spend $10,000 in the first six months of account opening.

The Venture offers 60,000 bonus miles after you spend $3,000 in the first three months of account opening.

To even the playing field, spending $10,000 in the first six months on the Venture X equates to about $1,667 in monthly spending. Meanwhile, the threshold is much lower for the Venture, with $1,000 in monthly spending.

While the spending minimum is higher on the Venture X, this shouldn’t come as a surprise as it’s a premium credit card. Plus, you’re looking at $1,850 in sign-up bonus value — compared to $1,110 on the Venture.

Winner: Venture X, as it carries a welcome offer that’s worth more than $700 toward travel than the Venture for a spending requirement that’s still reasonable.

Bonus categories

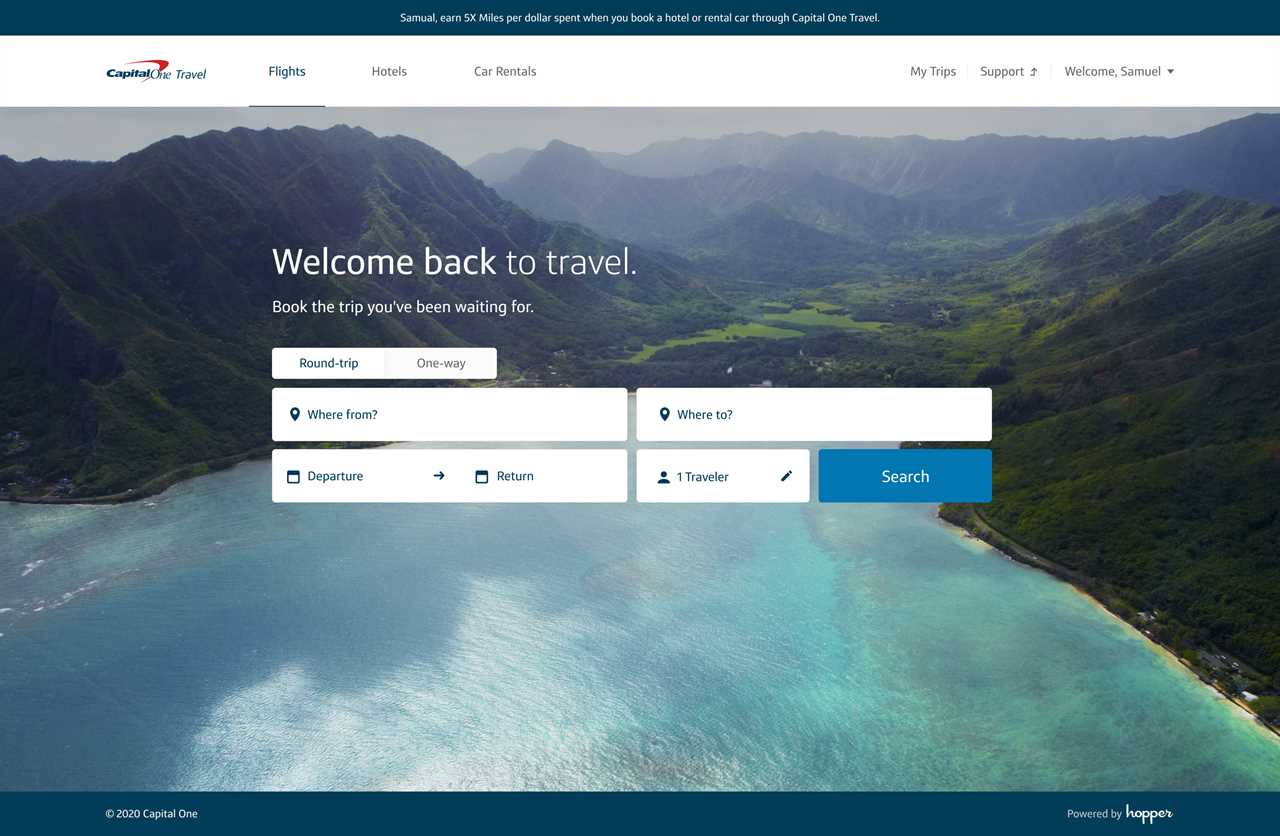

Earn bonus miles for booking travel through Capital One. (Screenshot courtesy of Capital One)

One of our favorite parts of the Venture is its approachable 2x earning rate on all eligible purchases. Cardholders who book hotels and rental cars through the Capital One Travel portal will enjoy an improved 5x earning rate on these purchases, specifically.

The Venture X takes the same 2x everyday earning rate that we love, plus additional travel-geared bonus categories. You’ll earn 10x on hotels and rental cars booked through the Capital One Travel portal and 5x on flights booked through the portal.

Winner: Venture X is the clear winner. But it’s worth pointing out that you may want to avoid booking hotels and rental cars through the portal if you’re pursuing or already have elite status since you likely won’t get any elite credits or benefits when you’re booking through a third party like this.

Redemption options

Fly United Polaris to South America for just 50,000 Capital One miles. (Photo by Zach Honig/The Points Guy)

Capital One currently has 17 total airline and hotel transfer partners. In 2021, the issuer revamped the transfer program for the better, though Capital One did lose its only domestic airline transfer partner, JetBlue TrueBlue.

With both the Venture and Venture X, your Capital One miles will transfer to partners at a 1:1 rate — save for a couple of programs, noted below:

Aeromexico Club Premier.Air Canada Aeroplan.Air France-KLM Flying Blue.ALL Accor Live Limitless (2:1).Avianca LifeMiles.British Airways Executive Club.Cathay Pacific Asia Miles.Choice Privileges (transfers won’t be available until later this year).Emirates Skywards.Etihad Guest.EVA Air Infinity MileageLands (2:1.5).Finnair Plus.Qantas Frequent Flyer.Singapore Airlines KrisFlyer.TAP Portugal Miles&Go.Turkish Airlines Miles&Smiles.Wyndham Rewards.Even if most of Capital One’s partners are international airlines, don’t discount them as there’s still tremendous value to be found if you can leverage the various programs’ sweet spots. Plus, having access to a greater number of transfer partners only helps you diversify your portfolio even more. Some of the notable programs include Air Canada Aeroplan, British Airways Executive Club and Turkish Airlines Miles&Smiles.

If simplicity is your thing, you can instead redeem your miles for any travel-related purchases on your statement at a rate of 1 cent each with either card. While this is under our valuation of 1.85 cents, this is a great way to reduce those other travel charges like group tours, ride-hailing services and more.

Winner: Tie. Though the Venture X carries a higher annual fee, it offers the exact same redemption options as the Venture.

Card benefits

Nap pods at the Capital One lounge. (Photo by Wyatt Smith/The Points Guy)

Perhaps the biggest difference between the two cards is the sheer number of benefits that come with the Venture X.

The Venture is a pared-down version of the Venture X, with only two annual passes to visit Capital One’s new airport lounges (there’s only one at Dallas-Fort Worth so far) per year and complimentary Hertz Gold Plus elite status. Like the Venture X, the Venture also offers a Global Entry/TSA PreCheck reimbursement credit.

On the other hand, with the Venture X, you’ll enjoy unlimited access to Capital One and Priority Pass lounges for you and up to two guests, up to a $300 annual travel credit for bookings made through Capital One Travel, complimentary Hertz President’s Circle elite status and cellphone protection.

Finally, with the Venture X you’ll receive 10,000 bonus miles every account anniversary, worth $185 based on our valuations. From the two tangible benefits — the 10,000 bonus miles and $300 annual travel credit — that’s $485 in value alone.

Winner: Venture X. The $300 annual fee difference gets you a steady amount of perks that will make an enormous difference in your travel experience. With unlimited access at Capital One and Priority Pass lounges, up to $300 in annual travel credit through the Capital One portal and more, the value of the Venture X’s more robust benefits becomes even more apparent.

When should you get the Venture X?

(Photo by John Gribben for The Points Guy)

The Venture X provides immense first-year value, from the 100,000-mile sign-up bonus to the limited-time up-to-$200 vacation rental statement credit. Coupled with the other perks on the card that are not found on the Venture, most travelers shouldn’t have any trouble justifying the higher $395 annual fee. That said, if you need some more convincing, here are some other reasons why you should apply for the Venture X instead.

We don’t know when the $200 vacation rental credit will disappear

The $200 vacation rental statement credit is a limited-time offer valid for the first year of account opening. We don’t know when this will no longer be offered to new applicants, so you’ll want to apply for the Venture X before they eliminate this credit as part of the sign-up bonus.

Generous authorized user benefits

While the $395 annual fee is steep, the benefits can be shared among up to four authorized users. If you have trusted family members or friends, you can add them for free and share unlimited access to Capital One and Priority Pass lounges (for your authorized users and up to two of their guests). Authorized users can also take advantage of the card’s comprehensive travel and purchase protections, which can be real money-savers when things go wrong on the road.

Cellphone protection

This is the first Capital One card to come with cellphone protection, a pretty amazing benefit if your phone gets damaged, stolen or even lost if it’s unrecoverable. To qualify, you’ll need to pay your monthly cellphone bill with the Venture X for reimbursement of up to $800 per claim and two claims ($1,600 maximum) per year, with a $50 deductible per claim.

When should you get the Venture?

The Capital One Venture card is packed with features and a solid welcome bonus. (Photo by Eric Helgas/The Points Guy)

Even though the Venture X wins in nearly every category that we analyzed, that doesn’t mean the Venture should be out of the running completely. Here are some reasons why I think the original Venture card is a solid pick for many.

The Venture X’s benefits don’t work with your lifestyle

If you travel too infrequently to maximize the full potential of the Venture X, then the Venture is likely better suited for you. Admittedly, the Venture X’s perks are designed for road warriors and frequent flyers. Capital One has only one lounge currently open at DFW, and while there are more in the pipeline, it will undoubtedly take time for the full benefit of Capital One lounges to be realized.

The credits on the Venture X, while lucrative, are still more limiting when compared to the $300 travel credit on the Chase Sapphire Reserve, which is one of the most generous credits we’ve seen on any card. So if you don’t want to commit to booking through the Capital One Travel portal, you might find it hard to take full advantage of the Venture X’s $300 annual travel credit.

You already have Priority Pass, Centurion Lounge or other lounge access

For many travelers, airport lounges are a saving grace to get work done or grab a meal before your flight departs. But if you already have another card that grants you Priority Pass or some other type of lounge access, carrying the Venture X may not be necessary for you.

For instance, the Amex Platinum grants you access to the Amex Global Lounge Collection, including the issuer’s own Centurion Lounges as well as Delta Sky Clubs (when flying Delta) and Priority Pass (except restaurant venues).

You’re looking for a fixed-rate rewards card for non-bonus expenses

At the end of the day, the Venture still offers 2 miles on all other eligible purchases — the same rate as the Venture. If you’re merely looking to add a flat-rate earning card to your strategy to maximize those purchases that tend to fall outside of common purchase categories, the Venture is still a fantastic card to earn all those extra points.

Bottom line

Capital One enters the premium card market with a splash, as the Venture X is perhaps the most exciting card launch we’ve seen in all of 2021. For most travelers, the Venture X is the uncontested winner. However, the Venture continues to stand its ground with its own set of benefits and a $95 annual fee that is much more approachable for award travel beginners.

Official application link: Capital One Venture X. Official application link: Capital One Venture.

Featured photo by John Gribben for The Points Guy.

Title: Credit card showdown: Capital One Venture vs. Capital One Venture X

Sourced From: thepointsguy.com/guide/capital-one-venture-vs-venture-x/

Published Date: Mon, 15 Nov 2021 20:00:18 +0000